Disfigurement compensation involves monetary awards for physical injuries causing long-term effects on quality of life. Specialized attorneys are crucial in navigating insurance complexities and securing fair settlements, especially in cases with indefinite emotional trauma and scars. Tax implications vary across jurisdictions, making compliance with federal and state laws vital through expert guidance from a qualified attorney.

“Disfigurement compensation, a crucial aspect of legal redress for physical injuries, comes with complex tax implications. This article explores the intricate relationship between disfigurement claims and tax laws, offering a comprehensive guide for those navigating this process. We delve into the legal perspective on disfigurement compensation, analyze how tax regulations impact claims, and provide essential insights on managing tax obligations after receiving such compensation. Understanding these complexities is vital for individuals seeking to maximize their financial recovery.”

- Understanding Disfigurement Compensation: A Legal Perspective

- Tax Laws and Their Impact on Disfigurement Claims

- Navigating Tax Obligations After Receiving Compensation

Understanding Disfigurement Compensation: A Legal Perspective

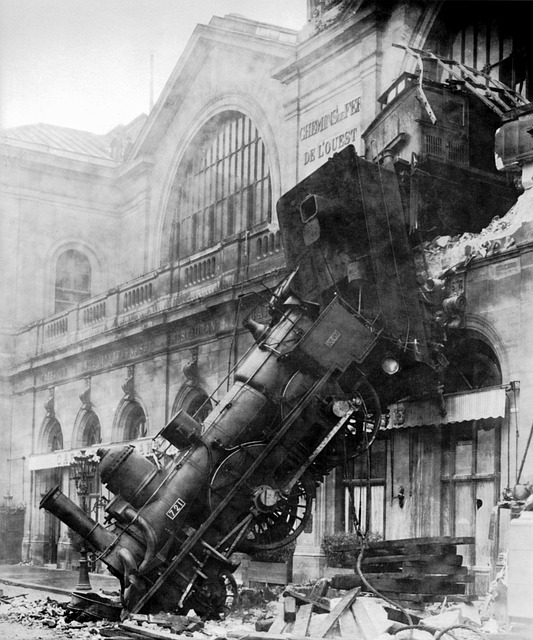

Disfigurement compensation refers to monetary awards given to individuals who have suffered physical disfigurements due to various circumstances, such as accidents, medical malpractice, or caregiver abuse. From a legal perspective, these compensation packages are designed not only to alleviate financial burdens but also to recognize and quantify the profound impact of disfiguring injuries on an individual’s quality of life. The process involves intricate assessments by medical experts and legal professionals to determine the severity and long-term effects of the disfigurement.

In cases like truck accidents, where severe injuries are not uncommon, a competent attorney specializing in personal injury claims can play a pivotal role. They guide clients through the complex web of insurance policies, settlement negotiations, and legal strategies to secure fair disfigurement compensation. This is particularly crucial when dealing with medical malpractice or caregiver abuse cases, where the emotional trauma and physical scars may persist long after the initial incident, underscoring the need for comprehensive legal support.

Tax Laws and Their Impact on Disfigurement Claims

The tax implications of receiving disfigurement compensation can be complex, largely influenced by a web of intricate tax laws. These laws vary across jurisdictions, dictating how and when such compensation is taxed, affecting both the claimant’s liability and potential savings. In many cases, disfigurement compensation is considered taxable income, subject to personal income tax rates. This includes settlements or awards from civil lawsuits, including those involving employment contracts or business litigation, where an individual has suffered disfiguring injuries due to someone else’s negligence.

Understanding these tax implications is crucial for individuals navigating the process of claiming disfigurement compensation. Consulting with a qualified accident attorney can help clarify the taxability of such settlements and ensure compliance with applicable tax regulations. This proactive approach allows claimants to make informed decisions, managing their finances effectively after receiving disfigurement compensation.

Navigating Tax Obligations After Receiving Compensation

Navigating Tax Obligations After Receiving Disfigurement Compensation

When an individual sustains disfigurement due to an accident or traumatic event and receives compensation, understanding the tax implications is crucial. The tax treatment of disfigurement compensation varies based on the jurisdiction and specific circumstances. In many cases, such compensation is considered taxable income, subject to federal and state tax laws. This means that individuals must accurately report the received funds on their tax returns, potentially affecting their overall tax liability.

A personal injury attorney specializing in disfigurement cases can offer valuable guidance on managing these obligations. They can help clients understand when and how to declare the compensation, ensuring compliance with tax regulations. In contrast to other types of settlements, like contract disputes, where certain components might be non-taxable, disfigurement compensation is generally treated as ordinary income, demanding careful consideration in financial planning and record-keeping.

Receiving disfigurement compensation can significantly impact your tax obligations, as discussed in this article. Understanding both the legal aspects of disfigurement claims and their interplay with tax laws is crucial for ensuring compliance and maximizing the benefits from such awards. By navigating these complexities, individuals can ensure that they are not only compensated for their suffering but also maintain financial stability post-settlement.